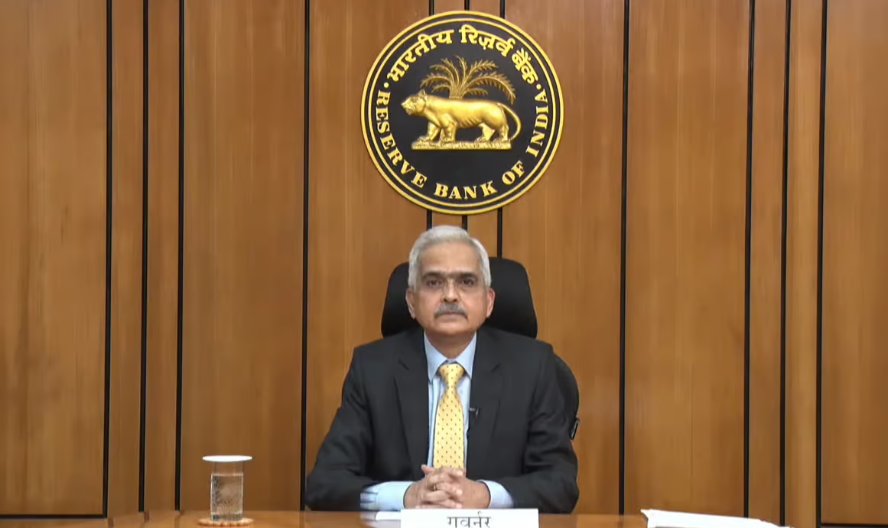

The Reserve Bank of India (RBI) Governor Shaktikanta Das, during the latest Monetary Policy Committee (MPC) meeting, announced that interest rates will remain unchanged, keeping the policy repo rate steady at 6.5%. However, the MPC has shifted its stance to a ‘neutral’ position, moving away from the earlier policy of ‘withdrawal of accommodation.

Optimism from the RBI Governor: A Positive Outlook for India’s Economy

RBI Governor Shaktikanta Das shared an optimistic view of the Indian economy, noting that it continues to display resilience and stability. He expressed confidence in controlling inflation, symbolized by his remark, The inflation horse has been brought back to the stable. This reflects the MPC’s belief that inflation is under control, which paved the way for changing the policy stance to neutral. Experts suggest that this shift may lead to a potential 25 basis point rate cut in December, which could boost equity markets, particularly in the banking sector.

Domestic Growth Outlook: Steady and Resilient

The MPC remains positive about India’s domestic growth, which continues to be supported by private consumption and investment. The resilience of the domestic economy provides the MPC with the flexibility to focus on aligning inflation with the target rate. This enduring price stability is expected to create a strong foundation for sustained economic growth in the future.

Key Policy Rates Remain Steady

The RBI has kept the policy repo rate under the liquidity adjustment facility (LAF) unchanged at 6.5%. Other key rates, such as the Standing Deposit Facility (SDF) and the Marginal Standing Facility (MSF), also remain steady at 6.25% and 6.75%, respectively. The MPC’s decision to maintain these rates reflects a cautious yet optimistic approach to India’s economic outlook.

GDP Growth Forecast: Steady Projections for FY26

The RBI provided an outlook on India’s GDP growth for FY26, projecting a robust average growth rate of 7.1%. Breaking it down by quarters, Q1FY26 is expected to see growth at 7.3%, followed by 7.2% in Q2FY26, and steady growth of 7.0% in Q3 and Q4FY26. These numbers reinforce the MPC’s belief in the strength and resilience of the Indian economy in the long term.

CPI Inflation Forecast: Moderate Expectations

The MPC also shared its CPI inflation forecast for FY26, projecting an average inflation rate of 4.1%. Quarter-wise, CPI inflation is expected to be 4.3% in Q1FY26, 3.7% in Q2FY26, and back to 4.2% in Q3FY26. This moderated outlook suggests that the RBI is confident in its ability to keep inflation in check over the next few years.

One MPC Member Votes for Rate Cut

During the MPC meeting, new member Nagesh Kumar voted for a reduction in the policy repo rate by 25 basis points. Although the majority voted to keep the rate unchanged, this suggests some divergence within the committee on how best to support growth while managing inflation.

UPI 123Pay Transaction Limit Increased

In a move to enhance the digital payment ecosystem, the RBI Governor announced an increase in the per-transaction limit for UPI 123Pay, from ₹5,000 to ₹10,000. Additionally, the UPI Lite wallet limit will also rise from ₹2,000 to ₹5,000, providing greater flexibility and convenience for users of digital payment platforms.

The RBI’s latest MPC meeting reflects a cautious yet optimistic stance toward India’s economic future. While interest rates remain unchanged, the shift to a neutral policy stance hints at potential rate cuts shortly, providing a positive outlook for equity markets and banking stocks. With steady GDP growth projections and manageable inflation expectations, the RBI is positioning itself to navigate the challenges of balancing growth and inflation control effectively. Keep following for more live updates on the evolving monetary policy.