Effective Duty Rates and Legal Framework

Effective Duty Rates and Legal Framework

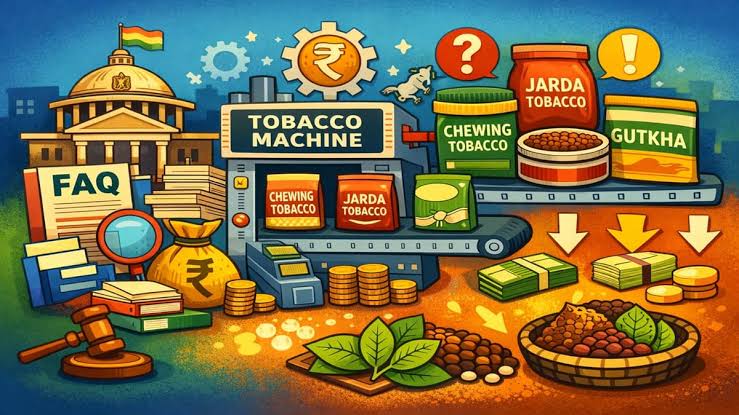

The effective rates of central excise duty on tobacco and tobacco products have been notified through Notifications No. 03/2025-Central Excise and 04/2025-Central Excise, both dated December 31, 2025. These rates will be applicable from February 1, 2026.

The Chewing Tobacco, Jarda Scented Tobacco and Gutkha Packing Machines (Capacity Determination and Collection of Duty) Rules, 2025 have been notified separately under Notification No. 05/2025-Central Excise (N.T.). These rules lay down the mechanism for determining production capacity and collecting duty accordingly.

The levy applies only to goods notified under Section 3A, namely chewing tobacco including filter khaini, jarda scented tobacco and gutkha.

Who Is Covered and Who Is Not

The rules apply exclusively to manufacturers producing the notified goods in pouch form using packing machines. Manufacturers producing these products in other forms, such as tins or jars, will continue to pay excise duty based on assessable value rather than deemed production.

Existing central excise registrants are not required to take fresh registration under the new rules. However, filing of the prescribed declaration is mandatory.

Mandatory Declaration and Technical Certification

All existing manufacturers must file Form CE DEC-01 within seven days of the rules coming into effect, making February 7, 2026 the deadline. The declaration requires details such as the number of packing machines, their maximum rated capacity, gearbox ratios and retail sale prices.

A Chartered Engineer’s certificate is mandatory to ensure accurate technical disclosure of machine specifications, including tracks, funnels and revolutions per minute of the main motor.

How Duty Is Calculated

Under the capacity-based levy, actual production is irrelevant. Duty is calculated on the deemed quantity produced based on the maximum rated capacity of the machine.

Until the department verifies the declaration, manufacturers must pay duty based on declared retail sale prices and machine speed. For instance, a machine producing chewing tobacco at 500 pouches per minute with an RSP of ₹2 will attract a monthly duty of ₹0.83 crore. If the RSP is ₹4, the duty rises to ₹1.52 crore per machine per month.

The final annual capacity is determined by the jurisdictional Deputy or Assistant Commissioner after physical inspection and verification.

Abatement, Sealing and CCTV Requirements

Abatement of duty is available if a machine remains non-operational for a continuous period of at least fifteen days. The abatement is calculated on a pro-rata basis, provided the department is informed in advance and the machine is officially sealed.

Any installed machine is deemed operational unless sealed as per rules. De-sealing also requires prior intimation and must be carried out in the presence of excise officials.

Manufacturers are also required to install functional CCTV systems covering all packing areas and preserve footage for a minimum of 24 months.

Returns, Appeals and Exports

Manufacturers must file a monthly statement in Form CE STR-1 by the 10th of the same month, in addition to regular excise returns.

In case the department determines a higher production capacity than declared, the differential duty along with interest becomes payable from February 1, 2026 for existing units. Filing an appeal does not exempt the manufacturer from paying duty as determined.