New Delhi, August 17, 2025: The State Bank of India (SBI) has revised its home loan interest rates effective August 1, 2025. India’s largest lender has raised the upper limit of its home loan rates to 8.70%, compared to the earlier 8.45%. The lower limit remains unchanged at 7.50%. This hike comes soon after the Reserve Bank of India (RBI) kept its repo rate steady at 5.55% in the August Monetary Policy.

Why SBI Raised Rates

SBI is the market leader in retail lending. When it revises rates, the impact is felt across India’s housing market. The new rates, between 7.50% and 8.70%, apply to regular term loans. For customers, this means higher monthly installments on larger home loans.

SBI increased the upper band by 25 basis points to adjust for funding costs. While this looks modest, even a small rate change can increase EMI burdens over a 20-year tenure.

How Other Banks Compare

How Other Banks Compare

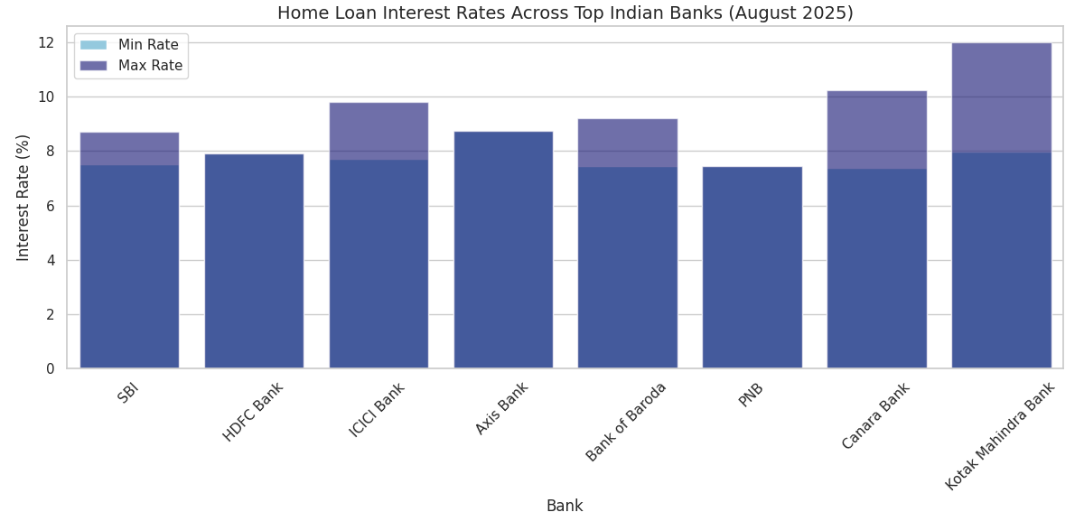

SBI’s move has drawn attention to what other banks currently charge. Here’s a snapshot of competing offers:

- HDFC Bank: Loans start at 7.90% p.a. for home purchase, balance transfer, and renovation loans.

- ICICI Bank: Interest rates range from 8.75% to 9.80% depending on loan amount and borrower type (salaried or self-employed).

- Kotak Mahindra Bank: Home loans start at 7.99% p.a. Existing customers switching to fixed rates face 12% p.a.

- Bank of Baroda: Offers loans between 7.45% and 9.20%, with rates linked to credit scores and loan amounts.

- Punjab National Bank (PNB): Rates start at 7.45% and vary by loan size and CIBIL score.

- Canara Bank: Loans range from 7.40% to 10.25%, making it one of the widest ranges in the market.

What This Means for Borrowers

For new borrowers, the hike increases borrowing costs. A loan of ₹50 lakh at 8.70% interest means an EMI rise of around ₹750 compared to 8.45%. Over the full tenure, this adds lakhs of rupees in additional repayment.

For existing floating-rate customers, banks usually pass on the increase in a few months. Borrowers with low credit scores will be hit harder, as risk premiums push their rates higher.

The Role of Credit Scores

Almost all banks now link home loan pricing to the borrower’s CIBIL score. A high score (750 and above) can fetch better rates, while weaker profiles face additional premiums. For example, Bank of Baroda levies a 0.05% risk premium if borrowers skip credit insurance cover.

Government Push for Housing

India’s housing sector is still supported by government schemes like Pradhan Mantri Awas Yojana (PMAY). Subsidies under PMAY help reduce effective borrowing costs for eligible customers. However, as interest rates rise, even these subsidies may not fully offset the EMI hike for middle-class buyers.

Looking Ahead

Experts believe interest rates will remain steady until RBI signals a change. If inflation cools, rates could soften next year. For now, borrowers must budget carefully and explore refinancing options.

SBI’s hike is a reminder that home loan rates are dynamic. Customers should compare banks, maintain strong credit health, and choose the most cost-effective options.